Fits digitalization like a glove.

Digital Banking is an infrastructure-independent platform built to deliver exceptional digital customer experience for the banking apps and workflows.

A revolutionary way to acquire and retain customers in the digital era.

Digital Banking platform is an ultimate solution for banking apps to run seamless processes such as customer acquisition or customer onboarding in a fully secured way. As soon as your customers express the need of a new feature or a new way of engaging with your bank, our platform serves the need without interrupting the daily routine of the bank continuing smoothless customer experience.

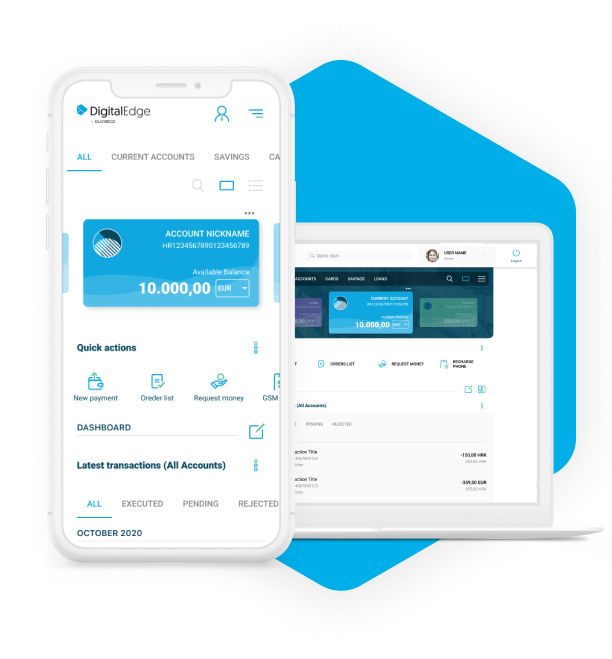

Prevent customer lock-in with omnichannel customer journey solution

More than 80% of banking customers are looking for a multi-channel solution that can serve their needs at any time, everywhere. Not surprising: more options means more flexibility and that is why ASEE digital banking platform focuses strongly on being there for your customers at any time so you can be a service provider they need.

Location independent platform

Where are your customers? Have any plans of going abroad with your products and services? Especially in the last couple of years, borderless service providing has become more than a need, it has become a reality. That is why DB platform enables banks to serve their existing and new clients from anywhere in the world.

APIs solution for any infrastructure

Every major functionality of Digital Banking platform can be accessed in a programmatic way. This makes it easy to integrate it with your existing infrastructure and solutions. Using our APIs, you can start and stop sessions, adjust capacity, and get real-time analytics.

Operational excellence and enterprise SLAs

What is your acceptable downtime when a problem happens in the middle of the weekend? Our team of engineers, devops specialists, and support ninjas is making sure that your apps are available at all times.

BPM and workflow solution that focus on digital services

Having a clear focus on service quality, speed and agility in order to address customer expectations is what makes Digital Banking workflow management and BPM technology a powerful tool that helps banks stay competitive by saving a ton of time on both sides – end customer processes and banks internal resources, delivering a true business value.

The future of flawless customer experience is here

And that future is in the cloud. Think about it: despite the rise of Web and mobile, thousands of critical applications still run only on premise. More than ever, we need tools that work together, seamlessly 24/7. With the Digital Banking platform, banking apps run in the cloud, so now you can control precisely what and when you want to run.

Digital Banking platform products

Our touchpoint applications let you meet and exceed expectations of increasingly demanding customers. Asseco’s omnichannel banking solutions turn your products and services into experiences across self-service and assisted touchpoints.

Omni-channel banking

Digital Origination by Asseco enables you to take control of your origination process with an easy-to-deploy and flexible solution which incorporates an embedded BPM engine, leading-practice process templates, and well-defined integration points.

Digital Sales and Onboarding

Our comprehensive solution fits the Berlin Group’s PSD2 framework and covers PSD2 end-to-end by combining 3 products critical for compliance – XS2A APls with Digital Edge, customer authentication with SxS and transaction monitoring with lnACT.

Open BankingReady to get started with digitalization?

Discover what’s possible with Digital Banking.

Request a demo, and we’ll reach out to walk you through what your bank needs to do in order to start acquiring and retaining customers more efficiently with Digital Banking platform.